My Favorite Online Brokerage Sites

Online Brokerage Sites are one of the best ways to streamline your search process, the ones you use and how you use them make an insane difference in outcomes and time spent on search. This list is meant to be as tactical as possible given the amount of SMB marketplaces out there (feels like there is a new one every single week). Below are some of my favorites.

Deal Aggregators

Deal aggregators should be the go to as they (theoretically) scrape and consolidate all active, online listings.

1/ DealMatch (https://getdealmatch.com/)

Why I like it:

Very granular filtering function

Can view 5 deals per day on Starter Plan (more than enough if you are checking daily)

How to Use:

Set your filters, check in for new deals daily, tinker with filters as you learn platform

I’d advise against the keyword function here, I’ve found it to be unhelpful

As a free user, I will copy & paste the keywords / descriptors of a listing that I am interested in into Google to take me to the direct listing

Opportunities:

I haven’t used the embedded Virtual Assistant option which seems like an extremely cost effective way of scaling your search

Pricing

2/ Kumo (https://app.withkumo.com/)

Why I like it:

Good UX, deal hiding function to avoid multiple looks at the same deal you’ve passed on

How to Use:

Set your filters, check in for new deals daily, tinker with filters as you learn platform

Highly recommend the keyword function on Kumo, very effective

As a free user, I will copy & paste the keywords / descriptors of a listing that I am interested in into Google to take me to the direct listing

Opportunities:

I haven’t leveraged the AI & CRM capabilities, seems interesting; albeit, I will always prefer Microsoft Excel as my CRM for simplicity sake

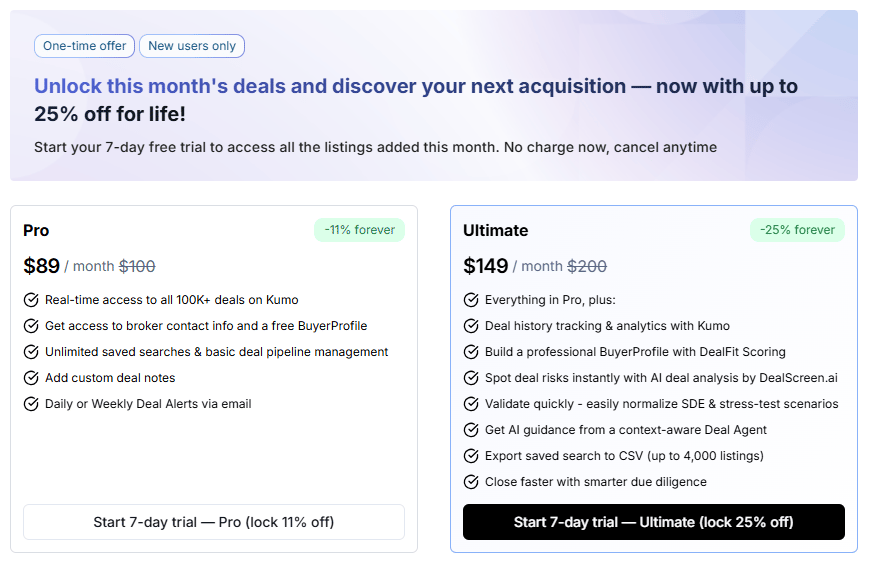

Pricing:

3/ BizBuySell (https://www.bizbuysell.com/)

Why I like it:

Historically, I have steered away from BizBuySell as EVERYONE is on it. So it is really hard to get good deal flow on there when there are so many eyeballs; however, I have found it to be useful as a quick check on active deals in your niche (keyword search is highly effective here). By definition, it is not a formal deal aggregator site, but basically every small business broker will repost their listing on there to maximize reach.

How to Use:

1-3x/week visit site and enter highly specific keywords based on your criteria into the search bar and view active listings

Opportunities:

BizBuySell Edge membership seems to include a lot for the price ($20/mo on annual plan; $25/mo on monthly plan) including personalized recommendations, buyer profile boost, and data analytics - that actually appears to be value-add including local demographic and real estate data and relevant acquisition comps. I personally have never heard of anyone using a paid account given the high functionality of the free tier; however, for the price it might actually be worth it.

Pricing:

Free tier (high functionality)

$20-25/mo for Edge membership (detailed above)

Online Business Listing Platforms

Online business listing platforms are websites that are focused on non-brokered transactions, connecting buyers & sellers directly with no intermediary.

1/ Flippa (https://flippa.com/)

Why I like it:

Probably the most popular site for online businesses

High functionality under Free account

How to Use:

The filters on this do not save (under free account), would recommend doing keyword searches and/or doing quick updates to filters 1x/week

Opportunities:

Primary benefit for paid account is First Access on deals (21 day buffer before getting released to non-Premium members), which is definitely worth it, I just haven’t done it

Pricing:

Free tier (high functionality)

$49/mo for Premium (purchasing decision detailed above)

2/ Acquire (https://app.acquire.com/)

Why I like it:

Acquire seems to have a high bar set for who they let on the platform (both Buyers and Sellers); Quality > Quantity

Very responsive team; have personally reached out to CEO, brokers, and legal team during an active deal (under LOI) as well as general listings; team has always been very responsive and actually value-add

All in all, this is the only brokerage platform I maintain a paid subscription for

How to Use:

Set up your criteria and leverage the ‘Browse’ tab as your main go to

Opportunities:

I have leveraged the AI agent in the past, but have not had much with it. The tool feels like it will increase at a compounding rate as more users interact with it.

Acquire Academy (full access included in membership) actually seems to be a very well thought out course; believe this would be a great resource and look forward to vetting myself in the future

Pricing:

You essentially need a paid account for Acquire.com, there are two accounts (couldn’t find the detail around Platinum, likely an upsell down the road vs initial option):

Premium: $390/year → access businesses <$250k LTM revenue

Platinum: $780/year → access businesses >250k LTM revenue

Online Brokerage Platforms

Online brokerage platforms are similar to online business listing platforms; however, the notable difference is that these platforms require you to go through a broker to interact with the seller.

1/ Empire Flippers (https://app.empireflippers.com/)

Why I like it:

Good deal flow volume, especially on the upper end of the market (>$50k/mo in cash flow)...essentially my go to for larger deals in the online space

Highly responsive and fast-moving team; brokers are actually value-add

How to Use:

The filters on Empire Flippers are very solid, actually save, and are easy to navigate; would recommend quickly setting up your filters and saving your search to easily access

You will need to verify your identity & funds to speak to sellers; would recommend just knocking this out so you are ready to rock n roll when a listing piques your interest

Opportunities:

None to my knowledge; the platform is very simple & straight forward - no bells & whistles. Heavily focused on catering to sellers vs buyers.

Pricing:

Free to buyers

2/ Website Closers (https://www.websiteclosers.com/)

Why I like it:

“Best in class” email notifications

Strong deal flow volume for quality listings

How to Use:

Create a free account and sign up for email notifications to get deal flow straight in your inbox. Contrary to most other platforms the email notification listing descriptions are very comprehensive…doesn’t feel like you need to “Click here to learn more”

Reach out to broker(s) on the platform to notify them of your deal criteria to ensure they are keeping you in mind (likely marginal benefit, but always a good idea)

Set up your criteria and leverage the ‘Browse’ tab as your main go to

Opportunities:

Buyer’s Club: hard to tell what exactly is included in the membership other than prioritization on listings; however, potentially worth looking into further for resources & tools

Pricing:

Free tier - allows full access to listings; however, you are noticeably de-prioritized behind Buyers Club members as you have to sign deal specific NDAs before having full access which typically takes 1-3 days

Buyer’s Club - $50/mo

3/ Quietlight (https://quietlight.com/)

Why I like it:

High deal volume, mostly on the upper end of the market

Competent brokers, most of which have “been there, done that” on the sell side (selling a company as a founder/owner) and/or buy side (acquiring a company) which goes a long way vs a broker who has solely done advisory

How to Use:

Sign up for email alerts (no filter option) and periodically peruse website. Quietlight’s listings are relatively high quality compared to other online platforms, so the email notifications you get are likely worth taking a look at (aka the no filter option doesn’t present overload issues)

Opportunities:

I’ve really enjoyed getting to know two of the brokers at Quietlight. I would recommend setting up a quick 30 min call for brokers that appear to consistently list businesses that are within your buy box. Establishing those relationships has actually felt to be worth my while.

Pricing:

Free - unaware of any paid membership options under Quietlight

Honorable Mentions

As mentioned earlier, this list is meant to be as abbreviated and as tactical as possible. For my focus area (online business), you should have your bases entirely covered with the list above. However, if you are curious, here are a few more that could provide marginal benefit (in no particular order):

Rejigg (https://www.rejigg.com/): probably my top honorable mention; Rejigg focuses on off-market SMB opportunities (literally cold calling small businesses to pitch them on listing on the site). Their platform is very comprehensive & easy to use. Support/brokers are essentially on-demand and just there to help, never in the way. Definitely worth checking out.

SMB Market (https://smbmarket.com/): paid deal aggregator that claims to have “more on & off-market listings” than anyone else. Seems solid, have never used myself.

Letter Trader fka Duuce (https://lettertrader.com/): only dedicated listing site for newsletter niche; low deal volume, however, very specific

Just Website Brokerage (https://www.justwebsitebrokerage.com/): credible website broker

FIH (https://fih.com/): online business broker; very solid team

FE International (https://www.feinternational.com/): higher end of the market, no public listings; worth getting set up on the platform and having a call with a member of the team for insights

Dealonomy (https://www.dealonomy.com/): basically a more tech enabled BizBuySell (broad coverage of listings, not restricted to online businesses), worth it to get signed up on the platform

Motion Invest (https://motioninvest.com/): content-focused digital assets (e.g., YouTube / blogs)

Array Capital (https://www.arraycapital.com/): small business software broker, worth it to sign up for their email notifications

Latona’s (https://latonas.com/): online brokerage site for cash flow positive digital businesses; very worth it to check periodically

The Website Flip (https://thewebsiteflip.com/): worth the 10 seconds it takes to sign up for the email notifications

Baton (https://www.batonmarket.com/): upper end of the market, high volume of off-market deals; good UX

Low Quality / Not Worth It

The biggest challenge in search is the amount of wasted time you can spend on the workflow. Here are a few sites I have come across that I have written off my list and don’t spend time on for either low quality listings, low deal volume, or very small deals. Having this list handy has been especially helpful for whenever I see a paid Instagram ad saying something along the lines of “The next unicorn awaits on [insert site].” The purpose of this list is to minimize distraction factors that can stem out of keeping track of too many sites, not an avoid at all costs list:

Investors.club (https://investors.club/)

Side Projectors (https://www.sideprojectors.com/)

Indie Maker (https://indiemaker.com/)

SMERGERS (https://www.smergers.com/)

Business Exits (https://businessexits.com/)

Niche Investor (https://nicheinvestor.com/)

Microns (https://www.microns.io/)

Acquisitions Direct (https://acquisitionsdirect.com/)

Takeaway:

Ultimately, your search workflow needs to be structured in a way that is as efficient as possible to acquire a company that fits your criteria. You will spend hundreds of thousands of hours on search, streamlining this process as much as possible is critical to staying competitive in the market by being quick to act on new listings.

Having a list of reliable sites with clear SOPs on how you stay up to date is one piece of the puzzle.

Think I missed something?

Think I mischaracterized anything?

Have any other thoughts or questions?

Want me to focus on something specific in an upcoming issue?

Let me know! Reply to this email, shoot me a direct note at [email protected] or connect & DM me on LinkedIn. I’d love to connect with each and every one of you to help in your journey.

~Mitch